What is securitisation? What is its history, how has it evolved, and what are the types of transactions? What is the difference between true sales and synthetic risk transfers?

Securitisation is the process of creating a marketable financial instrument in order to invest in a defined asset or asset pool.

These transactions gained particular attraction in the 1970s, starting with the financing of mortgage pools. From this point on, securitisation has evolved to include a more diverse array of underlying assets. These can be as varied as receivables, debt, shares, commodities or intellectual property, or real assets like art, infrastructure projects or real estate. Today, securitisation transactions have not only grown massively in developed markets, but also have evolved to become an important part of the global capital markets, particularly in the European and US markets.

During the late 1970s, depository banks were facing difficulties with securing short-term funding, facing a higher interest-rate demand and longer horizons from depositors and low mortgage rates. This combination of factors motivated the banks to reduce their mortgage portfolios, which in turn led to a slower rate of mortgage issuances, which ultimately depressed the housing market. With this situation at hand, Lewis Ranieri from Salomon Brothers came up with an innovative solution where he created 5- and 10-year bonds from 30-year mortgages. These bonds or mortgage-backed securities (MBS) helped both Ranieri and Salomon Brothers attract a larger crowd of investors, who purchased these MBS and took the mortgages off the bank‘s balance sheet. This transfer allowed the bank’s to issue fresh mortgages as the existing ones were repackaged and sold off.

Different criteria can be applied to distinguish between different types of securitisation transaction. The list is not exhaustive, but the following criteria should help to quickly distinguish and understand the two main categories.

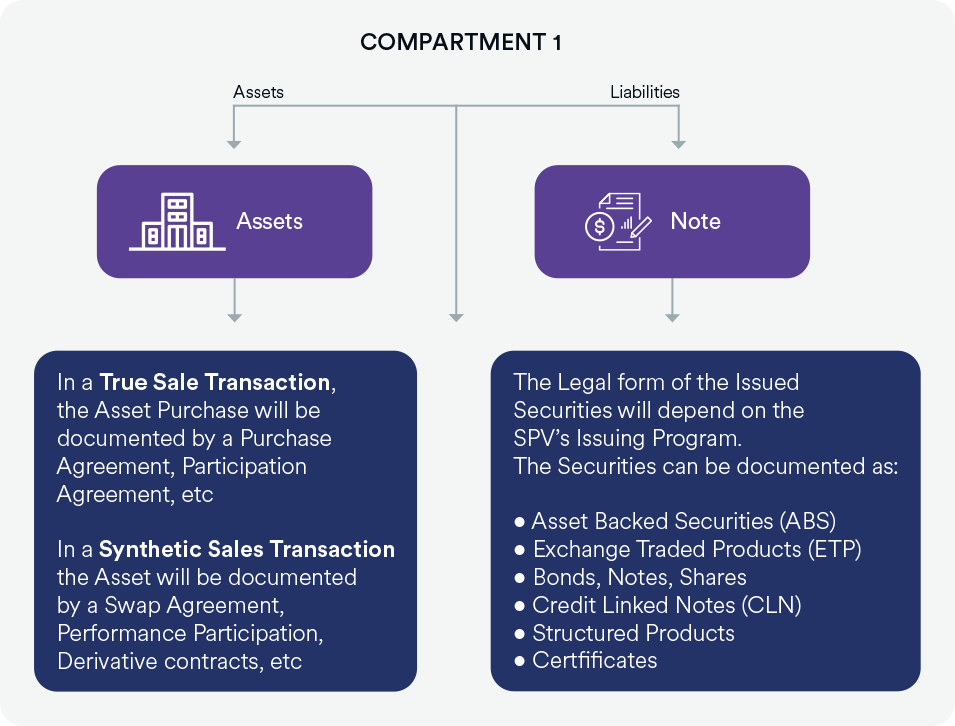

Depending on what the securitised asset is and on whether derivative products are used, securitisation is categorised either as “true sale” or “synthetic sale”.

Within the scope of a “true sale” transaction, the originator sells the ownership in a pool of assets to a securitisation vehicle.

Examples of “true sales” Risk Transfer - Securitisation:

However, within the scope of a “synthetic sale” transaction, the originator does not transfer the ownership of the underlying asset. The originator only transfers the Risk of the Underlying asset. This Risk Transfer can be done through a simple Loan Agreement or through a series of credit derivatives, total return swaps, guarantees or similar.

Would you like to learn more about Securitisation? Download our free e-brochure and learn all there is to know about the topic!

This document is prepared by ISP Securities Ltd., Zurich, exclusively for qualified/professional investors. It is designated to the person having received it from a representative of ISP Securities Ltd. and not intended for any other person. This document must not be made publicly available. This document is for information purposes only and is neither intended for nor targeted at any person who by domicile or nationality is prohibited to receive such information according to applicable law and regulations. This document is not intended to constitute an offer or solicitation nor a recommendation or advertisement for the purchase or sale of products or services and it is neither legal nor investment advice. While ISP Securities Ltd. makes reasonable efforts to obtain information from sources which it believes to be reliable, ISP Securities Ltd. makes no representation or warranty as to the accuracy, reliability or completeness of the information.

Unless otherwise stated, all figures are unaudited. The development of the values mentioned in this document originates in the past. Past performance is no guarantee for future performance. Each investment bears risks, such as value and profit fluctuations. Investments in foreign currencies may be subject to currency exchange rates. Particularly, ISP Securities Ltd. recommends that the recipient, if need be by consulting professional guidance, assess the information in consideration of his personal situation with regard to legal, regulatory and tax consequences that might be invoked. None of the information contained in this document constitutes financial advice or analysis within the meaning of the Swiss Bankers Association’s Directives on the Independence of Financial Research.

Our people and their combined skills, characters, and experiences represent our greatest assets. ISP Group is home to a team of over 80 highly qualified and motivated experts, focused and dedicated to help our clients reach their individual financial goals.