We offer our clients a unique and tailor-made asset solutions experience. Based on our state of the art processes and institutional, regulated system connections between SIX, the structurers and issuer of financial instruments, we enable seamless lifecycle management of all types of financial securities.

We service a broad network of asset managers, family offices and corporations and service financial securities with any type of underlying, including IP (film), royalties (fashion), real estate development and digital assets. We distinguish ourselves through our can-do mentality. We are a highly experienced partner with a proven track record of addressing and supporting the most complex securitisation requirements.

Our Paying Agent clients have successfully issued products with SPVs under the following jurisdictions:

• British Virgin Islands • Cayman Islands • Guernsey • Ireland • Jersey • Liechtenstein • Luxembourg • Malta • Mauritius • The Netherlands • United Kingdom

Our Paying Agent Team is open to working with additional jurisdictions and committed to introducing you to internal and external business partners who will provide/help you with the set up of the SPV.

2000+

issued Swiss

ISIN’s

12+

active SPV

jurisdictions

Cost−Efficient

with tailor-

made pricing

Experience

Highly experienced

professional team

Our Services

Our Paying Agent Services are FINMA-regulated. We are a Swiss Paying Agent and we offer our clients a unique and tailor-made asset service experience.

Based on our state-of-the-art processes and institutional, regulated system connections with SIX, enabling the structurers and issuers of financial instruments with a seamless life cycle management for all types of financial securities.

Our Team offers the following instrument types as Paying Agent:

Other forms of Certificates, Notes or Structured Products, or Exchange Traded Products (“ETPs”) and Asset Backed Securities (“ABSs”) can also be offered upon request.

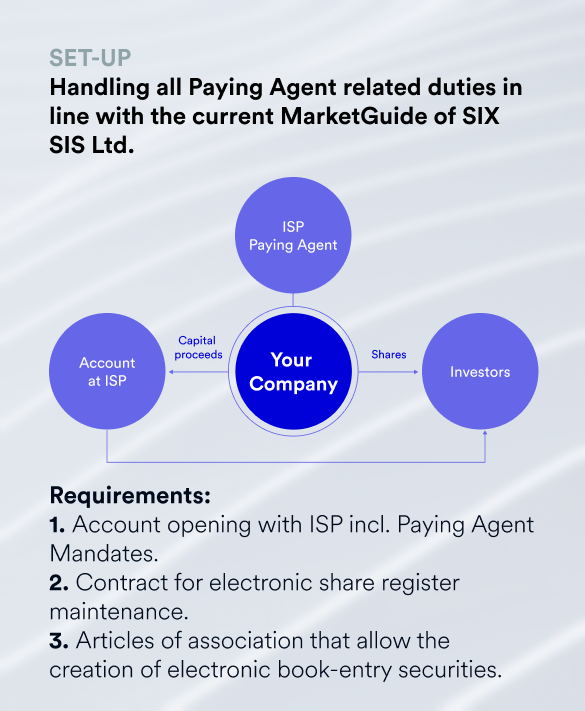

Example of Standard Products: Equity Issue

Company shares which are bankable provide more investment incentive for investors. Company shares in Swiss companies can be dematerialised easily; for companies abroad, it is more complex. With only three overall requirements, we will start the process of making your company shares bankable, thus providing them with a Swiss ISIN, and issue them on SIX SIS Ltd. The proceeds from a capital increase can be used for company-related investments and may be transferred to the company’s principal bank. Every additional capital increase is very easily executed afterwards with a corporate action.

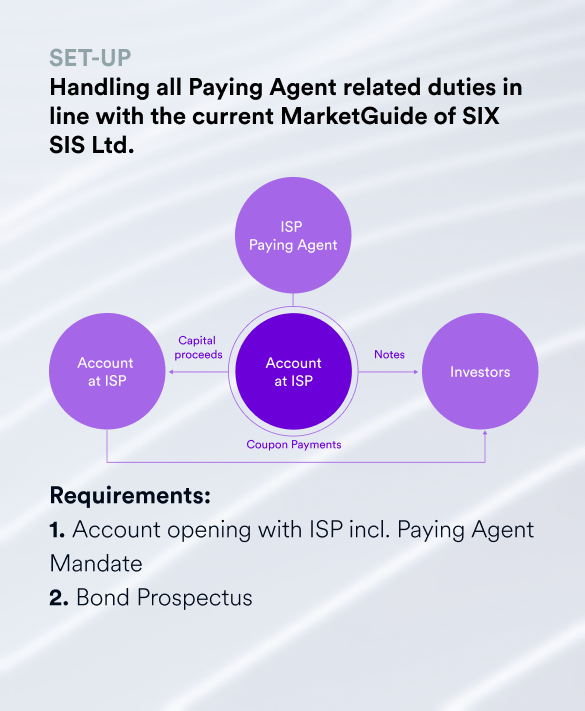

Example of Standard Products: Bond Issue

A bond issue can be of benefit for a company seeking debt financing for increasing their net working capital. Investors prefer to have the note booked in their own custody rather than only on paper, hence having the note bankable. ISP, as the paying agent, opens an account for the company in-house, and issues the note on SIX SIS Ltd. with a Swiss ISIN. The capital proceeds via subscription of the investors can be used for any company-related investments and may be transferred to the company’s principal bank.

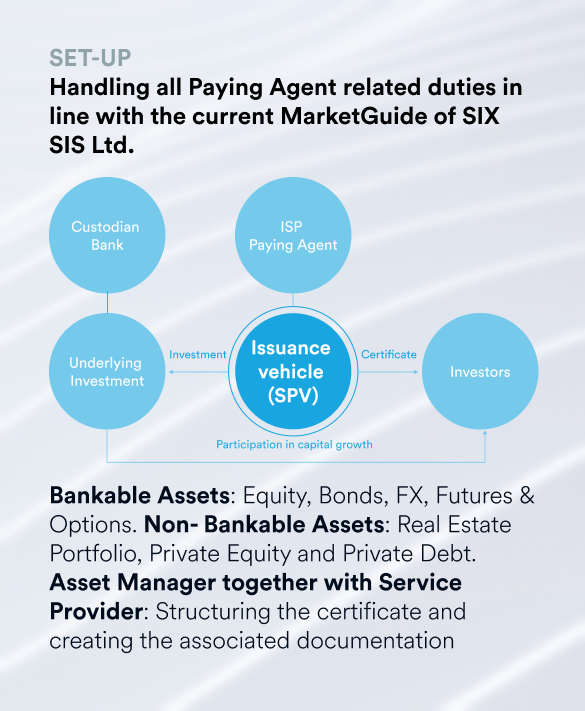

Example of Simple Products: Actively Managed Certificate (AMC)

Clients are able to implement a strategy (on bankable or non-bankable assets) in a simple and straightforward procedure. The composition of the underlying may be changed based on the decisions of the asset manager during the term of the certificate. AMCs combine the flexibility of structured products (favorable tax structure, low entry level, speed of issuance, efficient cost structure) with those of classic investment funds (portfolio diversification and adaptability to different market conditions). AMCs with ISP as the paying agent will be issued with a Swiss ISIN on SIX SIS Ltd. and opened on Euroclear and Clearstream. An asset manager can change the balance of their portfolios with one order instead of placing their trades at several banks.

Example of Complex Products: Credit-Linked Notes (CLNs)

Conventional bank loans are in many cases prohibitively expensive; an individually designed, tradable certificate with a private loan as the underlying asset has become a more compelling solution. Investors who buy CLNs generally earn a higher yield on the note in return for accepting exposure to specified credit risks. The optimal solution, where the reference unit, tenor and currency can be adjusted independently of each other and are packaged in a Swiss ISIN. Issued through a Special Purpose Vehicle (SPV), there are no direct credit risks for the asset manager itself.

Example of Standard Products: Equity Issue

Example of Standard Products: Bond Issue

Example of Simple Products: Actively Managed Certificate (AMC)

Example of Complex Products: Credit-Linked Notes (CLNs)

Our Paying Agent Team serves the following securitised investment strategies as a Paying Agent:

Our Paying Agent Team serves the following securitised investment strategies as a Paying Agent:

Actively Managed Certificates (AMCs)

At ISP Group, we structure your off-balance-sheet, risk-segregated trading strategy. The certificate can be easily distributed among qualified investors.

Private Equity

The securitised Private Equity investment becomes a bankable asset. This is a highly efficient way to access global capital markets, as the issued EMTNs are provided with an ISIN and traded through global clearance and settlement platforms, such as Euroclear.

Islamic Finance

Islamic Finance does not allow for investments into interest-bearing (“riba”) products. Islamic securities are based on participation in the underlying business risk instead. Hence, the core requirement of Islamic Finance products is that of being asset-based or asset-backed. As such, an asset-backed security is the natural fit for structuring Islamic Finance transactions.

Real Estate

Securitisation of real estate converts the asset into a tradeable security on the financial markets. This is a flexible and efficient way to raise capital, to fund a real estate development project or to get the real estate portfolio off the balance sheet.

Green Bonds

Institutional investors can securitise their investment strategy or assets into an EMTN and apply for green bond certification in collaboration with Sustainalytics.

Art, IP, and other Tangible and Intangible Assets

Art has become increasingly popular as an asset class in the post-financial-crisis investment landscape. Investment opportunities in art, collection items or intellectual property (IP) such as brand royalties, music or film rights are typically illiquid and difficult to access.

Fund Shares

The securitisation of fund shares provides a bridge between the fund and the investor, allowing fund managers to sell to institutional investors through a new channel of broker dealers and private banks.

Digital Assets

Securitisation of cryptocurrencies and other tokens.

Private Debt

Private loans can be securitised into any type of bond, incl. convertibles. This is a highly efficient way to access institutional fixed income investors worldwide.

Our typical securities are generally structured and launched through Special Purpose Vehicles (SPVs) from cost-and-tax-efficient jurisdictions.

Each SPV is normally an individual solution based on a client’s preference. Most frequently used issuance jurisdictions are Jersey & Luxembourg. Other key jurisdictions serviced include Guernsey, Cayman Islands, Ireland, Liechtenstein, Malta, Mauritius and United Kingdom

ISP would be happy to check the addition of further jurisdictions and can introduce business partners to provide bespoke SPVs.

Our typical securities are generally structured and launched through Special Purpose Vehicles (SPVs) from cost-and-tax-efficient jurisdictions.

Each SPV is normally an individual solution based on a client’s preference. Most frequently used issuance jurisdictions are Jersey & Luxembourg. Other key jurisdictions serviced include Guernsey, Cayman Islands, Ireland, Liechtenstein, Malta, Mauritius and United Kingdom

ISP would be happy to check the addition of further jurisdictions and can introduce business partners to provide bespoke SPVs.

Jersey

Luxembourg

Guernsey

Cayman Islands

Ireland

Liechtenstein

Malta

Mauritius

United Kingdom

Our team consists of experts in the field of securitisation. We take a dynamic, dedicated and tailored approach that enables us to realise our clients’ goals and visions. With our can-do attitude, we strive to serve our clients with the highest level of professionalism in the most efficient way.