With a CLN, investors can expand their existing universe of financial instruments and get access to a less correlated asset class – the private debt market. CLNs have numerous advantages compared to loans or bonds. ISP Group and its highly experienced teams will support you throughout the entire process, acting as Arranger, Introducer, Calculation Agent and Paying Agent.

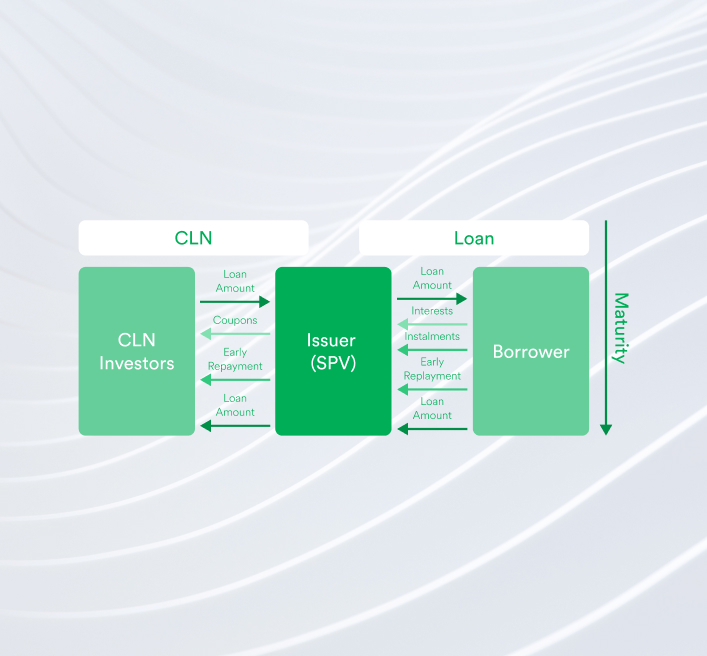

CLN stands for Credit Linked Note. A Credit Linked Note is an instrument for securitising private loans in order to make them bankable. The CLN is issued with a Swiss ISIN as a tradable security. CLNs serve as an alternative to conventional bank loans, which in many cases are prohibitively expensive.

A single loan can be securitised and funded by numerous investors via a CLN, providing better terms to both borrowers and lenders.

With a CLN, investors can expand their existing universe of financial instruments and get access to a less correlated asset class – the private debt market.

Typical projects associated with CLNs are:

Want to learn more? Download our brochure.

Opportunity

The product initiator identifies a borrower who needs funds for a project. The product initiator, who may be also the borrower, has access to investors who are willing to provide those funds.

Loan Agreement

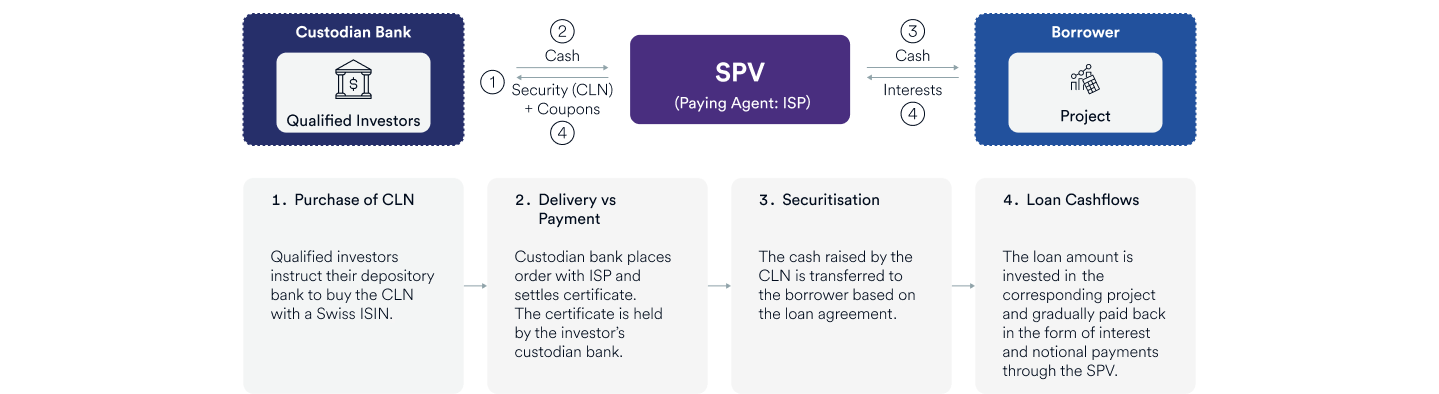

ISP, as a Paying Agent of the CLN, will perform due diligence on the potential borrower and a corresponding loan agreement will be drafted.

Securitisation

The loan is securitised with a Swiss ISIN. The CLN investors will receive the certificate and the proceeds will be transferred to the borrower.

Interest Paid

Coupons derived out of the loan interest are paid to CLN investors. At loan maturity, the amount lent is repaid through the SPV to the investors thereafter.

The product initiator identifies a borrower who needs funds for a project. The product initiator, who may be also the borrower, has access to investors who are willing to provide those funds.

ISP, as a Paying Agent of the CLN, will perform due diligence on the potential borrower and a corresponding loan agreement will be drafted.

The loan is securitised with a Swiss ISIN. The CLN investors will receive the certificate and the proceeds will be transferred to the borrower.

Coupons derived out of the loan interest are paid to CLN investors. At loan maturity, the amount lent is repaid through the SPV to the investors thereafter.

Buying a CLN is as easy as buying a stock or a bond. Investors can simply place the buy order with their custodian bank using the CLN’s unique ISIN code. The respective bank then trades with the Paying Agent directly or uses a bridge partner if no direct trading line exists. Learn more about our Paying Agent Services

Our typical securities are generally structured and launched through Special Purpose Vehicles (SPVs) from cost-and-tax-efficient jurisdictions.

Each SPV is normally an individual solution based on a client’s preference. Most frequently used issuance jurisdictions are Jersey & Luxembourg. Other key jurisdictions serviced include Guernsey, Cayman Islands, Ireland, Liechtenstein, Malta, Mauritius and United Kingdom

ISP would be happy to check the addition of further jurisdictions and can introduce business partners to provide bespoke SPVs.

Our typical securities are generally structured and launched through Special Purpose Vehicles (SPVs) from cost-and-tax-efficient jurisdictions.

Each SPV is normally an individual solution based on a client’s preference. Most frequently used issuance jurisdictions are Jersey & Luxembourg. Other key jurisdictions serviced include Guernsey, Cayman Islands, Ireland, Liechtenstein, Malta, Mauritius and United Kingdom

ISP would be happy to check the addition of further jurisdictions and can introduce business partners to provide bespoke SPVs.

Jersey

Luxembourg

Guernsey

Cayman Islands

Ireland

Liechtenstein

Malta

Mauritius

United Kingdom

Arranger

We act as a communication bridge to external stakeholders in supported jurisdictions.

Paying Agent

We create securities with Swiss International Security Identification Numbers (ISINs) which we apply for SIX SIS, Euroclear and Clearstream.

We service these securities during their lifetime, for example by processing corresponding coupon payments.

Introducer

We guarantee you access to ISP’s existing partner network.

You can choose from a well-established list of reliable and best-in-class service providers.

Calculation Agent

We determine the Net Asset Value (NAV) of securities on a daily basis.

We provide you with a price publication on SIX Telekurs and Bloomberg.

Arranger

We act as a communication bridge to external stakeholders in supported jurisdictions.

Paying Agent

We create securities with Swiss International Security Identification Numbers (ISINs) which we apply for SIX SIS, Euroclear and Clearstream.

We service these securities during their lifetime, for example by processing corresponding coupon payments.

Introducer

We guarantee you access to ISP’s existing partner network.

You can choose from a well-established list of reliable and best-in-class service providers.

Calculation Agent

We determine the Net Asset Value (NAV) of securities on a daily basis.

We provide you with a price publication on SIX Telekurs and Bloomberg.

Experience

With well over 1’000 ISINs serviced, ISP has unparalleled experience in securitising any sort of asset.

Understanding

As professional Asset & Wealth Managers, our understanding of our clients' needs is inherent to our practice.

Securities Firm

We are a long standing, reputable Swiss securities firm, with a broad team of product & securitisation experts.

Skills

Our highly skilled relationship managers, product specialists and traders are accompanied by experts within onboarding, legal & compliance and many more fields.

Trading Lines

700+ financial institutions have open trading lines with us, allowing our clients numerous advantages.

Partners

In addition to our inhouse trading services, our clients are also provided with access to trading via several prime brokers in the market.

Flexibility

We always put our clients and their needs first, we are highly flexible and can accommodate any needs.

Other Forms of Securitised Assets

Apart from AMCs, CLNs and Trackers, ISP can also help to transform assets into:

Our team consists of experts in the field of securitisation. We take a dynamic, dedicated and tailored approach that enables us to realise our clients’ goals and visions. With our can-do attitude, we strive to serve our clients with the highest level of professionalism in the most efficient way.