With equity mandates, a private company’s equity is turned into a bankable asset. This gives investors more investment incentives. ISP Group can support you throughout the whole process, from dematerialising your physical shares to listing your shares on the BX or SIX Swiss exchanges.

Company shares which are bankable provide more investment incentives for investors.

With equity mandates, your private company’s equity is turned into a bankable asset with a Swiss ISIN (through issuance via SIX SIS) that is easy to transfer.

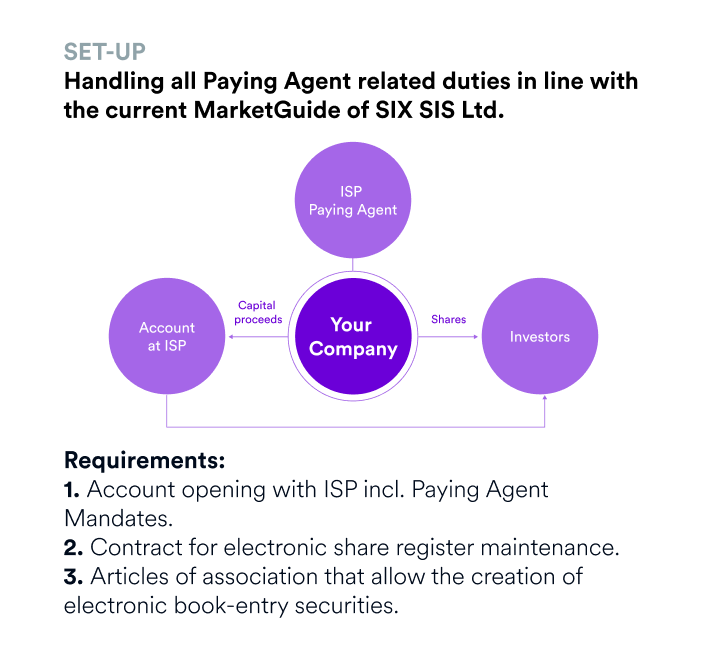

A private company must fulfill the following requirements to have ISP service an equity mandate:

How is your company’s equity transformed into a bankable asset?

1. ISP will help the client to dematerialise the company’s shares. By dematerialising the physical shares, ISP creates electronic shares with the respective value and delivers these to shareholders’ custody accounts at their custodian banks.

2. Every additional capital increase after that will be really simple to execute with a corporate action.

3. In a potential further step, ISP can even help to list your shares on the BX or SIX Swiss exchanges. Learn more about our Liquidity Provision services.

Paying Agent

We provide Swiss-based companies with Swiss International Security Identification Numbers (ISINs).

We issue the shares on SIX SIS Ltd..

We service these securities during their lifetime (i.e. open accounts, create value rights, execute dividend payments).

Custodian

The private company will receive a company account at ISP.

Arranger

We will introduce and arrange contact between the private company and the necessary stakeholders (such as a share registry).

Paying Agent

We provide Swiss-based companies with Swiss International Security Identification Numbers (ISINs).

We issue the shares on SIX SIS Ltd..

We service these securities during their lifetime (i.e. open accounts, create value rights, execute dividend payments).

Custodian

The private company will receive a company account at ISP.

Arranger

We will introduce and arrange contact between the private company and the necessary stakeholders (such as a share registry).

We have already successfully accompanied numerous private companies on their journey to dematerialising their physical shares.

As your Swiss financial services boutique, we are a full-service advisor and the main point of contact for collaboration with SIX SIS Ltd. to facilitate the dematerialisation of your company’s shares.

Our highly experienced professional team has issued more than 1'000 Swiss ISINs, providing cost-efficient services with tailored pricing.

Other Forms of Securitised Assets

Apart from AMCs, CLNs and Trackers, ISP can also help to transform assets into:

Our team consists of experts in the field of securitisation. We take a dynamic, dedicated and tailored approach that enables us to realise our clients’ goals and visions. With our can-do attitude, we strive to serve our clients with the highest level of professionalism in the most efficient way.