In recent years, the private markets industry has seen exponential inflows through securitisation vehicles. Asset managers and associated parties have begun to prefer the easier access that securitised solutions can provide into otherwise hard-to-get private assets, such as Private Equity and Private Funds.

What are Private Equities / Funds?

Private Equity

Private Equity has long been a highly interesting market for many; however, it used to be very hard to access. For decades, promising returns to an uncorrelated market have lured potential investors towards Private Equity. With securitisation, Private Equity has finally become a bankable asset and therefore easy to engage in for any qualified investor. This is a highly efficient way to access global capital markets as the securities issued are provided with an ISIN and traded through global clearance and settlement platforms, such as SIX SIS, Euroclear and Clearstream.

Private Funds

The same is true for Private Funds, which were only accessible to high-net-worth investors with good connections for a long time. The securitisation of fund shares finally provides a bridge between the fund and the investor, allowing fund managers to sell to qualified investors through a new channel of broker dealers and private banks.

Problem: Private Equities (such as Revolut, Space X, Klarna) and Private Funds (such as KKR, Blackstone) are hardly accessible for the normal qualified investor. Very often there are significant barriers to entry in the form of high minimum investment amounts and massive associated paperwork. The usual physical paper contract normally cannot be booked with the investor’s custody account.

Solution: Securitising private shares or funds in either a tracker or an AMC offers numerous advantages:

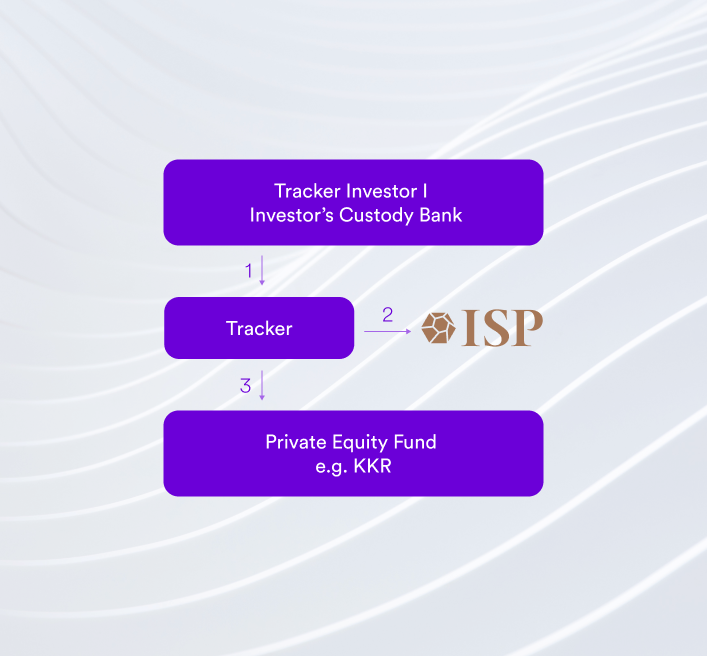

Simplified Example: Using a Tracker to Invest in a Private Equity Fund (such as KKR)

Typically, the ISP Group would be approached by a professional asset manager to securitise a Private Equity Fund. However, it could be anyone interested in providing easier access to such private instruments to a selected investor base.

1. Qualified investors instruct their custody bank to buy the tracker certificate via the Swiss ISIN.

2. Through this buy transaction, the investor receives tracker certificates booked into their custody account, while the buying price in cash flows into the tracker’s account at ISP.

3. As soon as cash has arrived at ISP, we, in our role as paying agent, invest the cash proceeds into the Private Equity Fund according to pre-defined rules.

Experience

1.000+ ISINs serviced

Understanding

As professional Asset & Wealth Managers, our understanding of our clients' needs is inherent to our practice.

Securities Firm

We are a long standing, reputable Swiss securities firm, with a broad team of product & securitisation experts.

Skills

Our highly skilled relationship managers, product specialists and traders are accompanied by experts within onboarding, legal & compliance and many more fields.

Trading Lines

700+ financial institutions have open trading lines with us, allowing our clients numerous advantages.

Partners

In addition to our inhouse trading services, our clients are also provided with access to trading via several prime brokers in the market.

Flexibility

We always put our clients and their needs first, we are highly flexible and can accommodate any needs.

Our team consists of experts in the field of securitisation. We take a dynamic, dedicated and tailored approach that enables us to realise our clients’ goals and visions. With our can-do attitude, we strive to serve our clients with the highest level of professionalism in the most efficient way.