We provide services that help transform assets or investment strategies into financial instruments (Structured Products, Funds Units, ABS, ETP, Certificates, Notes, Bonds, Fund Feeders). The solutions are implemented in different jurisdictions, including Luxembourg, Jersey, Guernsey, Malta and Liechtenstein.

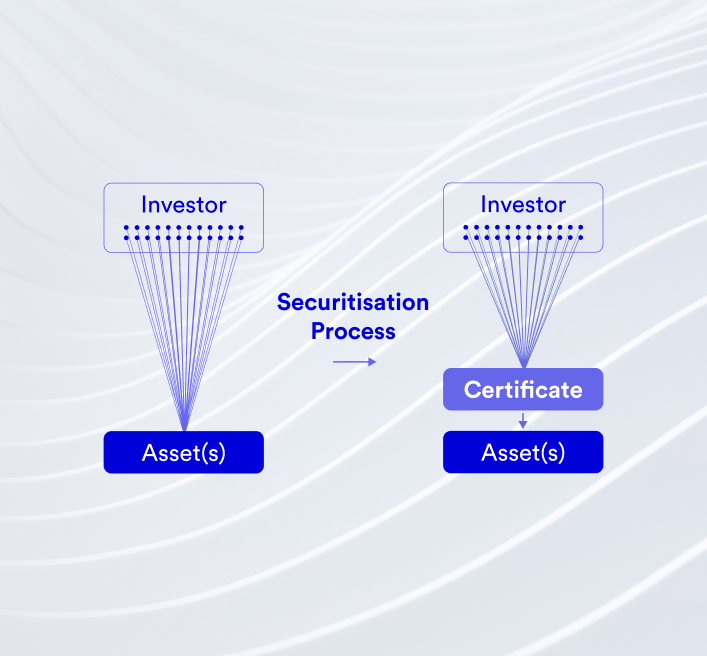

Securitisation is a simple way of bundling a right into a certificate. Predominantly, such a right is often linked to the performance of one or more underlying assets. Securitising risky assets is often more beneficial compared to purchasing the underlying asset for every single investor.

Securitisation can be seen as an innovative way of pooling various financial assets in one single bankable instrument that can be distributed to numerous qualified investors.

Typical assets that are securitised by professional asset managers are:

The most typical types of certificates used to securitise such assets are:

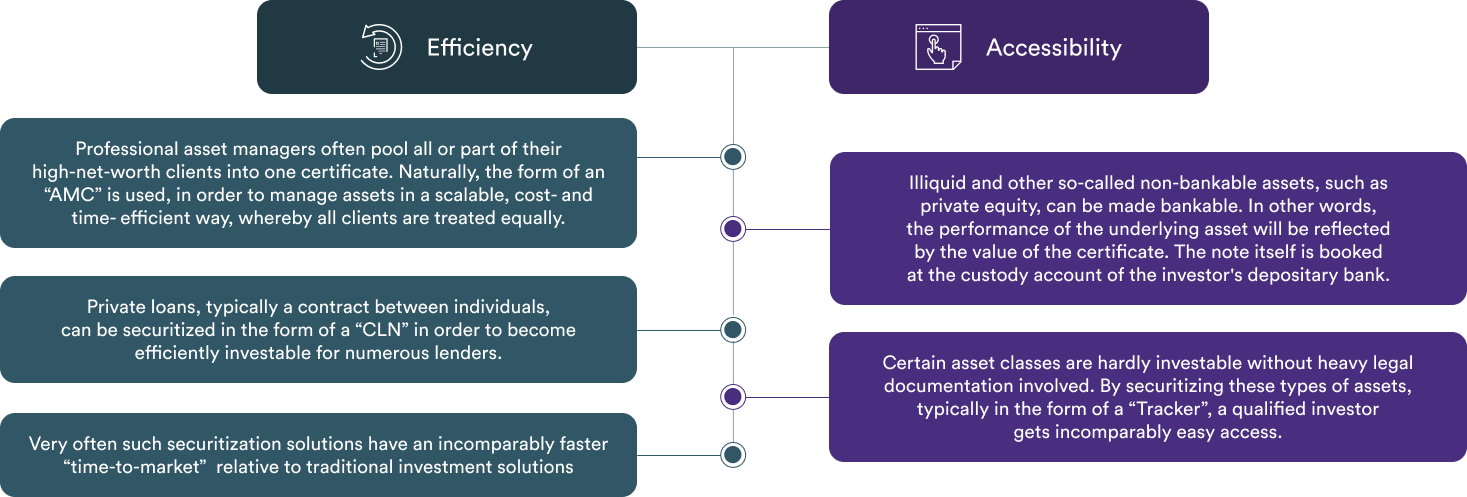

The securitisation of risky assets creates two main benefits, among others;

Securitisation offers a variety of significant advantages when compared to traditional investment vehicles. Major benefits include increased flexibility, reduced cost and improved operational efficiency.

Increased Flexibility

Structure your certificates flexible way in terms of seed money, tenor, investment universe, etc.

Cost-Efficiency

Enjoy both lower setup fees and lower recurring costs compared to traditional investment solutions

Access to Capital

Gain access to global capital markets and diversify your investor base

Secondary Market

Trade your strategy on the secondary market and offer your investors easily transferable securities

Creating a Track Record

Establish a proven track record for investors and grow your business

Life Cycle Management

Outsource the life cycle management of your investment and focus on developing your projects

Integrated Administration

Simplify the administration of your investment vehicle and benefit from collaboration with our top service providers

Increased Flexibility

Structure your certificates flexible way in terms of seed money, tenor, investment universe, etc.

Cost-Efficiency

Enjoy both lower setup fees and lower recurring costs compared to traditional investment solutions

Access to Capital

Gain access to global capital markets and diversify your investor base

Secondary Market

Trade your strategy on the secondary market and offer your investors easily transferable securities

Creating a Track Record

Establish a proven track record for investors and grow your business

Life Cycle Management

Outsource the life cycle management of your investment and focus on developing your projects

Integrated Administration

Simplify the administration of your investment vehicle and benefit from collaboration with our top service providers

Certificates facilitated by ISP are typically issued out of specially established Special Purpose Vehicles (“SPVs”). An SPV is comparable to a newly established company with an initially empty balance sheet. After incorporation, the SPV typically issues a debt certificate (equity is also possible, though) such as an AMC, Tracker, CLN or similar.

Upon the issuance of a certificate, the corresponding products will appear on the SPV’s liability side. The SPV itself has no further liabilities. The products are therefore covered 1:1 by the underlying assets and do not bear traditional issuer risk. As soon as investors buy the product either on issuance or on the secondary market, the raised capital flows into the SPV’s asset side.

What is the difference between an AMC, a Tracker and a CLN?

In the case of an AMC, the Asset Manager decides how to allocate the clients' cash according to his investment strategy.

When it comes to a Tracker, the cash will be invested based on a pre-defined rule set in the tracked underlying.

Regarding CLNs, the cash will be transferred to the borrower’s bank account.

The core service providers present in almost all securitisation projects run by ISP are the Paying Agent, the Calculation Agent, the Corporate Administrator, the Custodian, the Broker and the Asset Manager. In very complex securitisation projects, up to a dozen and more service providers might be involved in the process, such as a Trustee, a rating agency, an auditor, or a third-party advisor for legal, accounting or tax purposes. ISP will help to coordinate corresponding introductions where required.

Paying Agent

The Paying Agent services the product’s payments and settlements.

Calculation Agent

The Calculation Agent makes associated calculations such as NAV, interest payments, etc..

Corporate Administrator

The Corporate Administrator administers the bankruptcy-remote and ring-fenced SPV platform.

Custodian

The Custodian is responsible for the safe custody of the strategy’s assets such as equities, bonds, or similar.

Broker

The Broker trades the assets where necessary.

Asset Manager

The Asset Manager allocates cash on a discretionary basis according to a pre-defined investment strategy.

Paying Agent

The Paying Agent services the product’s payments and settlements.

Calculation Agent

The Calculation Agent makes associated calculations such as NAV, interest payments, etc..

Corporate Administrator

The Corporate Administrator administers the bankruptcy-remote and ring-fenced SPV platform.

Custodian

The Custodian is responsible for the safe custody of the strategy’s assets such as equities, bonds, or similar.

Broker

The Broker trades the assets where necessary.

Asset Manager

The Asset Manager allocates cash on a discretionary basis according to a pre-defined investment strategy.

Experience

With well over 1’000 ISINs serviced, ISP has unparalleled experience in securitising any sort of asset.

Understanding

As professional Asset & Wealth Managers, our understanding of our clients' needs is inherent to our practice.

Securities Firm

We are a long standing, reputable Swiss securities firm, with a broad team of product & securitisation experts.

Skills

Our highly skilled relationship managers, product specialists and traders are accompanied by experts within onboarding, legal & compliance and many more fields.

Trading Lines

700+ financial institutions have open trading lines with us, allowing our clients numerous advantages.

Partners

In addition to our inhouse trading services, our clients are also provided with access to trading via several prime brokers in the market.

Flexibility

We always put our clients and their needs first, we are highly flexible and can accommodate any needs.

Our team consists of experts in the field of securitisation. We take a dynamic, dedicated and tailored approach that enables us to realise our clients’ goals and visions. With our can-do attitude, we strive to serve our clients with the highest level of professionalism in the most efficient way.