Within a bond mandate, ISP helps private companies to issue bonds. By issuing bonds via bond mandates, companies have better access to investors. ISP and our experienced teams will support you throughout the whole process.

A bond (fixed-income security) is a financial instrument for the purpose of borrowing funds from investors as debt capital.

The proceeds from issuing such bonds can serve numerous financing purposes

In order to facilitate a bond issuance, ISP will require:

If a company meets the above requirements are met, it can raise funds without many obligations apart from interest payments and redemption.

It is usually, but not exclusively, for the long-term financing of a company.

The capital proceeds raised by investor subscriptions can be used for any company-related investments and may be transferred to the company’s principal bank.

Advantages of a Bond Mandate

The idea behind a company issuing bonds via bond mandates is to provide better access to investors, enabling them to have a tradable electronic instrument with a Swiss ISIN.

Advantages of Bond Mandates:

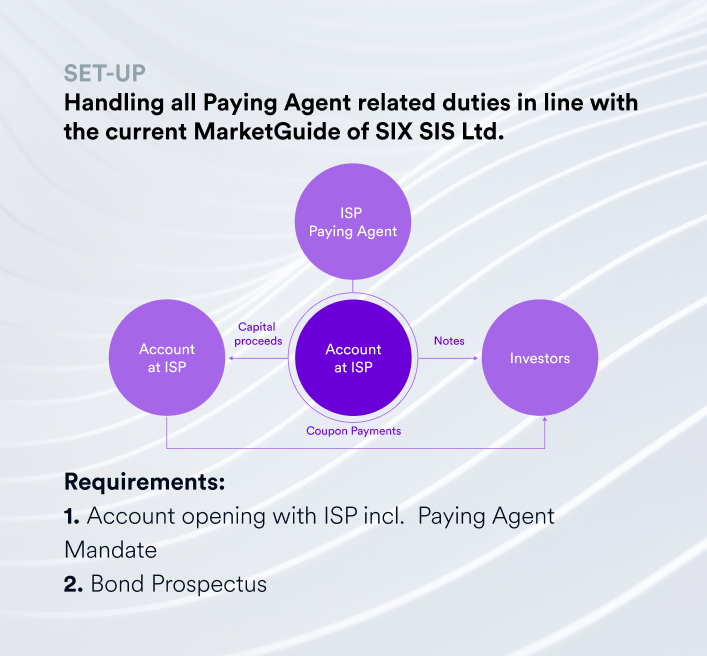

ISP, as the Paying Agent, opens an account for the company in-house, and issues the note on SIX SIS Ltd. with a Swiss ISIN.

ISP services these securities throughout their lifetime (i.e. open accounts, creates value rights, executes coupon payments).

ISP enables companies to issue electronic bond certificates to their investors which can easily be custodised with the respective value rights at their banks.

ISP, as the Paying Agent, opens an account for the company in-house, and issues the note on SIX SIS Ltd. with a Swiss ISIN.

ISP services these securities throughout their lifetime (i.e. open accounts, creates value rights, executes coupon payments).

ISP enables companies to issue electronic bond certificates to their investors which can easily be custodised with the respective value rights at their banks.

ISP Group has already accompanied numerous bond mandates in partnership with a global clientele.

As your Swiss financial services boutique, we are a full-service advisor and the main point of contact for collaboration with SIX SIS Ltd. to raise additional financing through bond issuance.

We set ourselves apart thanks to our can-do mentality. So far, our highly experienced professional team has issued more than 1’000 Swiss ISINs, providing cost-efficient services with tailored pricing.

Other Forms of Securitised Assets

Apart from AMCs, CLNs and Trackers, ISP can also help to transform assets into:

Our team consists of experts in the field of securitisation. We take a dynamic, dedicated and tailored approach that enables us to realise our clients’ goals and visions. With our can-do attitude, we strive to serve our clients with the highest level of professionalism in the most efficient way.